In a world increasing its use of on-line applications over legacy installations, some people still prefer to install programs on their home or work computers instead.

With regards to online applications, there is no need for installations anymore, or even upgrades – only one instance of the application is live, with only one application of upgrades, if it is ever needed. But with legacy installations, you will have to go through some time installing the program, checking if the program works fine on your operating system, and then upgrading the program to its latest version.

TurboTax Home and Business is one such program. Every year, people go online to purchase the  latest version of TurboTax for their tax preparation software.

latest version of TurboTax for their tax preparation software.

It is a legacy installation on either the Windows or Mac operating system which, in the best conditions, will take probably the better part of a morning to finish. With that out of the way, the rush to meet the deadline for the filing of tax returns begins.

Year after year, TurboTax continues to earn the top spot on tax software list. It consistently prepares accurate returns and is by a long shot the easiest to use online tax software. To make TurboTax even more appealing, for the first time in 2012 they are offering free personalized tax advice to all types of tax filers – even those using their free federal e-File service.

If you are quicken and TaxAct user, you can transfer your past tax returns to TurboTax. So switching should not be difficult.

Not Often the Best Conditions

If you read the Amazon reviews on TurboTax Home and Business 2011, you will find most of the nightmares of a legacy installation on the page. Assuming the best conditions for any program to be installed on your home computer always comes with a lot of prayers to the computer gods – you hope that everything works out fine, but in case it doesn’t, you hope the faulty installation does not ruin the rest of your files on the computer.

It would be great to have a tech savvy person available during the whole installation process. At the very least, you have someone to keep you company during that interminably long installation process where all you see is a progress bar you hope sincerely with all your heart moved since the last time you checked it.

Fortunately, there is an easy fix if you ever run into problems during installation, and it is also the last solution you will hear from the tech support from all parties. Do your taxes on the web-based TurboTax version.

Doing Taxes on the Cloud

That is where you should be doing your taxes in the first place to avoid any complicated installation instructions – on the web. As a cloud-based application, you will rarely, if ever, run into any problems with the application. The software is safely installed on their servers, and all you need is a browser that is secure enough for all your information to be private.

That is the only supposed drawback of cloud applications – its security. But compare that to the headaches of installing the program, then add again the problems of security, using cloud-based applications is the best choice. In case you haven’t heard because you are still too busy installing programs on your machine, the cloud is the future.

Pros of using TurboTax

- Start all returns for free and don’t pay until you are ready to file.

- Free technical support with Basic, Deluxe, Premier and Home & Business editions.

- TurboTax offers free live tax support over the phone and chat. You can also contact TurboTax for support through email.

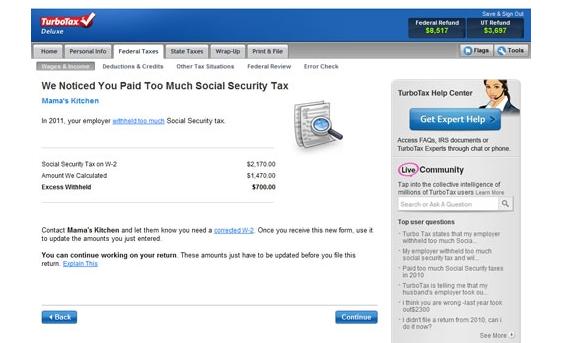

- Checks for errors as you input information, reducing errors by typo.

- You can refer/store/save information from past/present years, and it also allows you to import some forms directly, or look up your W-2′s using their database.

- TurboTax provides Audit Defense to represent you during tax audit, if happens. They schedule and attend all audit appointments and handle all audit correspondence. Audit Defense costs an additional $39.95.

- TurboTax is owned by Intuit Inc. who are in business for over 20 years.They provide an Accuracy Guarantee to reimburses you if you are assessed a penalty based on a miscalculation on behalf of TurboTax tool.

- TurboTax also offers a Maximum Refund Guarantee, which ensures you get the biggest tax refund possible using their system.

Cons of using TurboTax

- Very annoyingly it will try to get you to upgrade your product at every step. Not all tax forms are supported in all versions, so it’ll prompt you to upgrade if you need something that’s in a more expensive version.

- Highest in price compared to other tools. Additional fee for state filing.

- TurboTax is a computer software program and can only do what it is programmed to do, so if you need in-depth tax help and preparation for a complex financial situation it is best to seek out a professional tax consultant.

Is TurboTax for you?

The cost of filing your federal tax return ranges from $0 to $74.95, depending on which product fits your needs. If you have state tax return to file, it will cost you $36.95, which is more expensive compared to competing products from other brands. You pay the total price only after you file your return.

I file my tax return every year using TaxAct.com and I don’t pay for that service, except for the first tome payment I made to them 5 years ago.

We’ve found that TurboTax is an excellent tax products. The best features are error checking, on-screen guidance, and tax support. In fact, TurboTax also provide free live professional tax support.

Definitely TurboTax has an advantage over traditional Tax consultant in your neighborhood in terms of cost of filing your taxes.

But you surely miss the personalization a tax consult would provide. Over all we are unable to recommend the product for your tax need. But there are 1000s of filers using this version with ease. Depending on your familiarity with tax codes and rules, you may decide to use it or skip it.

We are giving TurboTax home business edition tax product a “skip” rating. We recommend TurboTax only for those who need robust guidance and support for filing taxes.

| Thank you for reading this article. If you like my blog, consider subscribing to Finance Product Reviews via RSS or email. You can also subscribe via Facebook or Twitter by clicking on those icons on the top. Thank you! |

Disclaimer: Finance Product Reviews is an independent website. Although we may have advertisement relationship with financial institution we review, they do not influence our decision or rating of products. Contents of this site are not provided by any financial institution, banks, brokerages or credit card issuers. Opinions expressed here are author’s alone and are not reviewed, approved or otherwise endorsed by the product owners.

I’ve never used TacAct but I have filed my taxes via TurboTax online for the past 5 years. I love them and would highly recommend the online version.

Good to know that. I did with TaxAct online and never faced issues in past

i sure love me some Turbotax.

I have been using it for 8 years running now, and can’t imagine doing my taxes any other way.

I just finished doing 15 corporate tax returns with Turbo Tax. It is relatively straight forward and easy to use; much easier than doing it by hand and a lot cheaper than paying a CPA or EA to do it for you.

I have used H&R Block and Turbo Tax in the past for doing my own taxes and have to say I much prefer H&R Block for my tax needs. Though very similar, I just find H&R Block easier to use overall.

I’ve used H&R Block taxCut the last 4-5 years, and I liked it better than turbotax at the time I switched. Plus it was able to import my Turbotax files so I was sold (for significantly less than turbotax too.)

That’s great to hear

I’m surprised by your “skip” rating, only because TurboTax is such a household name now. Your review raises some real concerns, though, and definitely gives us a great overview of the product. Thanks for another thorough post.

I appreciate the feedback Joe

[…] at Finance Product Reviews walks us through the Turbo Tax Home edition. It’s a thorough review and includes several reasons you might think twice before buying. I like […]

[…] Platform Review » Taxact.com Review – Act Now for your Taxes Earlier we have reviewed Turbo Tax Home Edition at FPR. Now presenting the tool that I personally use for our tax return. […]