Bank of America Add It Up program is online shopping portal come rewards program. Participation in which is free and may generate cash back rewards on your regular day-to-day shopping.

Who can enroll in Add It Up

Membership in Add It Up requires you to have Bank of America credit or debit card, and have enrolled in online banking.

Residents of Washington and Idaho cannot participate,

Small Business credit card only customers can not participate.

Some BOA cardholders are ineligible, including holders of other BOA-issued rewards cards like Upromise, TripRewards, etc.

How to enroll in Add It Up

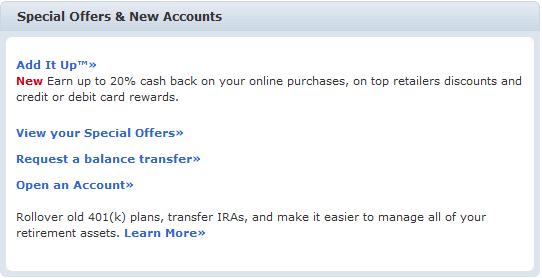

You need to have Bank of America online account. If you have a checking account/ saving account/CD or a credit card account, you will see link in the special offers section, “Add It Up” on account summary page (the one you get immediately after successful login).

Click on the link, On the next page, you need to fill in your name and the account with which you are enrolling in to Add It Up.

Give your consent to terms and condition, and click submit. You are done!

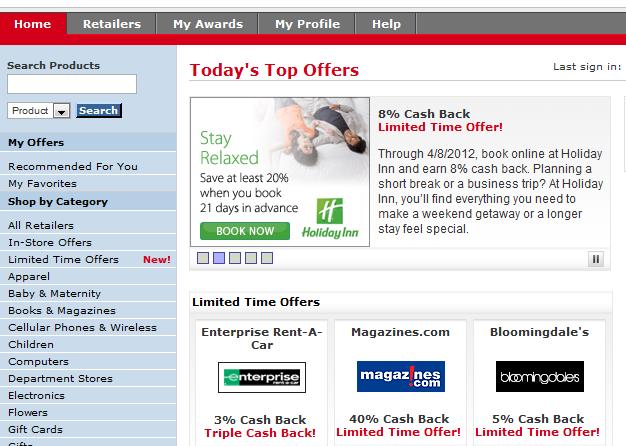

Once you get to the Add It Up home page, you will see several offers. If you look at the left navigation, you can see that you can search their online retail partners by category. There are limited time offers, searches and a few recommendations for you.

How you are paid in Add It Up

Your Add It Up transactions will appear in your account within 20 days, and will be given a ‘pending’ designation until the merchant pays BOA, within 30 to 90 days.

Payments are then made to members on a monthly basis, around the 25th of the month. If your cash back earnings (meaning the purchases that went from Pending to Earned status) from the 21st of the prior month through the 20th of the current month are $5 or more, you’ll receive your cash back, as an ACH deposit to your debit card or a statement credit to your credit card account. Otherwise, your earnings will roll over to the next month.

Add It Up rewards summary

1. Several big-name merchants are featured as special offers with BOA matching (doubling) cash back up to $250 through 7/12, at Home Depot (3% doubled to 6%), Staples (4% doubled to 8%), Target (4% doubled to 8%, excluding gift cards), Wal-Mart (2% doubled to 4%, excluding gift cards), and Sears (3% doubled to 6% and gift cards ARE included). Note that you’ll earn all of the original cash back rate but BOA will match/double up to a total of $250 across all of these merchants.

2. Add It Up has a coupon/discounts section, providing coupon codes or links for many of their participating merchants.

3. Add It Up has more than 500 participating merchant, out of which more than 50% merchants are either exclusive to this program or provide highest cash back compared to other programs.

4. Add It Up’s rates are outstanding to high-average compared to other cash back rewards programs. Some examples: Buy.com at 3% cash back (versus around 1.5% elsewhere), Avon at 9% (versus 6 to 7% elsewhere), Dell Home at 2% (3% elsewhere), Kmart at 3% (2% elsewhere), Macy’s at 4% (same as competitors), Office Depot at 4% (around 3% elsewhere), PETCO at 7% (8% elsewhere), and ToysRUs at 2% (same as competitors).

5. You can enrol in Add It Up using your bank of America debit card, in a sense, this is an unique opportunity for non credit card users.

Recommendation for Add It Up

If you pay your credit card off in full each month, or if you have an eligible Bank of America debit card, this program is definitely worthwhile.

My overall recommendation for effective use of credit cards stays. Unless you are paying off full balance every month, there is no point in adding cash back rewards. The little money, whatever, you earn through cash back is more than offset by the interest late on the card.

To take full advantage of any cash back program, like Add It Up, you need to stop paying interest by paying off your card every month.

Of course, that’s good advice for anyone using any online rewards program. Bank of America’s new cash back rewards program, Add it Up, gets two thumbs up from Finance Product Reviews.

This program mainly focuses on online sites but has also begun to add some in store promotions as well.

As per reports, Add It Up is second largest in terms of merchant participation after Citi bank Bonus Cash Center program. Many more of your purchases would become eligible for add it up, compared to any other similar program from Chase or Capital One, etc.

There is no point in applying for a credit card just to take advantage of Add It Up program. But, if you have bank of america bank account or credit card already, you should apply for Add It Up! I have a bank of america checking account and a credit card, so I did enrol for this program.

Another good aspect is, even if you don’t have a credit card, you still can take advantage of Add It Up through your debit card.

We give overall “enrol” rating for “Add it up”.

| Thank you for reading this article. If you like my blog, consider subscribing to Finance Product Reviews via RSS or email. You can also subscribe via Facebook or Twitter by clicking on those icons on the top. Thank you! |

Disclaimer: Finance Product Reviews is an independent website. Although we may have advertisement relationship with financial institution we review, they do not influence our decision or rating of products. Contents of this site are not provided by any financial institution, banks, brokerages or credit card issuers. Opinions expressed here are author’s alone and are not reviewed, approved or otherwise endorsed by the product owners.

[…] admitted, “I did learn about tax forms [Free From Broke], Social Security [My Dollar Plan], Bank of America Add It Up Rewards [Financial Product Reviews], and dividend investing [Dividend Growth Investor], I learned about […]