I use two brokers for my personal need before I tried Zecco. MB Trading platform and Merill Lynch which came along with my Bank of America Checking account as an additional benefit. I would say it was probably only boon for me from the stock market collapse of 2008. You may want to read my earlier review of MB Trading, which I found one of the very best in business.

I have been using Zecco just for the sake of comparison. As MB Trading started a recent no-activity fee which is irritating to me. Now I do think I would switch to Zecco from MB Trading. Here’s what I found from the discount online brokers, Zecco.

Zecco is an online stock broker. This company has offices in San Francisco, California, Glendale. Word ZECCO means “zero cost commission” trading. This company is operating since July, 2006. However since March 2011 this company is no longer providing free stock trading to its customers. Zecco provides stock, option, mutual fund, bond trading, spot foreign exchange trading service, spot gold, spot silver trading services to its customers.

How To Set Up Account For ZECCO

It is an easy three step process to sign up for Zecco which takes hardly 10-15 minutes to set up an account. Firstly you will need to pay signup fee via wire transfer, paper chec or through ACH transfer from your bank account etc ways. Also you will need to fill all your information including your social security number. Then after 2-3 days you will get your ready to trade account. 2 to 3 days are required for transferring funds. For me it took almost 6 days as there was a week end in between. I remember I had to wait for 15 days for Merill Lynch account to be active and tradable.

Fees and Commissions on Trading

- For Stocks: – they charge $ 4.95 for each trading. also if you trade on equities which are equal to $ 1.00 or less then charges for this trading are 6.95$ per trade. 4.95 $ is way too less than what its competitor companies are currently charging for each transaction.

- Options: – they charge 4.95$ for each trade and additional 0.65$ for each contract. This is very beneficial if the contacts are very less. But if you are taking large number of contracts then this becomes very costly. If this trading is broker assisted then you will be charged $ 19.99 plus charges on each contract is 0.75 $

- Broker assisted trades are 19.99 $

- Zecco provides super cheap price structure also it is very easy to understand this structure.

- Forex spreads are 0.7 pips for major pairs.

- Margin rate is 4.5%

- You can purchase or sell no-load mutual funds via Zecco. If this transaction is internet based then you are charges $ 10 per transaction.

- Treasury transaction fee is $ 24.50 per transaction.

- Bond transaction fee is $ 4.50 per transaction. But the minimum transaction amount is $ 22.50.

Investments Offered by Zecco

Stocks, options, bonds, mutual funds, retirement account education savings accounts, spot gold and spot silver. They are now offering Forex trades too. I am inclined towards Forex trades these days.

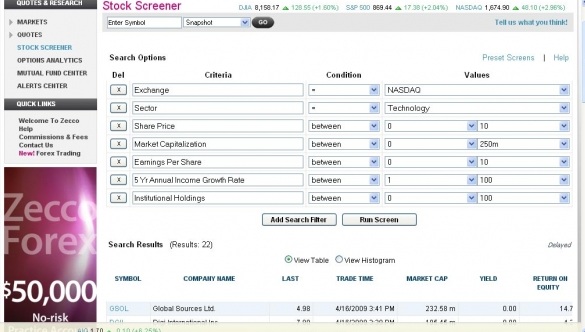

Trading or Investment Tools

Trading platform offered by Zecco is very basic. Yet they have decent tools for trading complex options. They have tool for identifying potential investment and to analyze them. Also you get tool for trading and to monitor your portfolio.

As a trading help, they do provide free real time quotes, charts and graphs (which MB trading charges fees for) . Also research report is provided to you by standard and poor. In addition to this if you are newbie in the trading field and if you need any guidance on trading, there’s a help for you in form of Zecco’s investor education tool. Also they provide educational videos. Though I found the videos very basic.

Zecco provides descent customer support. You can contact their customer service via email or phone or through online chat. They are trying to establish a trading community – Zeccoshar, where you can share and discuss your issues, opinions and insights with other investors. This his cool feature I think.

Verdict on Zecco brokerage account

Pros:

- Very low commission on trading stocks ( 4.95 $)

- Active social networking community to share and discuss your problems with other traders.

- Free 24×7 online or offline support.

- Free streaming data.

- Free dividend reinvestment.

- No surcharges for large orders.

- You can open account with Zecco with no money down.

- No account minimum, maintenance or deactivation fees.

Cons:

- There are no II level quotes.

- There is no online mobile trading access for massively used Blackberry or android phones.

- Performance reporting and tax planning services are not free.

- Surcharges of $2 on trad of penny stock.

- Annual IRA fee is $30.

- Extra hour traders have to pay surcharge of $0.005 per share on applicable commission

Conclusion

If you have good experience in trading and if you are looking for low cost and solid service provider, then Zecco is the one of the best options available for you. Trading Education tools are just OK and there are no extra ordinary material there but, still sometimes they are useful for many. Additionally online social community is the best thing for traders. So overall Zecco is good for experienced people and they should open an account with Zecco. But if you are looking for intensive research performed on stocks then Zecco may not be the best option for you

Readers, what are your opinions about Zecco? If you’re an account holder, are you satisfied?

| Thank you for reading this article. If you like my blog, consider subscribing to Finance Product Reviews via RSS or email. You can also subscribe via Facebook or Twitter by clicking on those icons on the top. Thank you! |

Disclaimer: Finance Product Reviews is an independent website. Although we may have advertisement relationship with financial institution we review, they do not influence our decision or rating of products. Contents of this site are not provided by any financial institution, banks, brokerages or credit card issuers. Opinions expressed here are author’s alone and are not reviewed, approved or otherwise endorsed by the product owners.

[…] equal to $ 1.00 or less then charges for this treading are 6.95$ per trade. … Excerpt from: Zecco Trading Review – Online Stock Brokers that are not Zero Cost … ← Everything You Need to Understand About Stock Trading Investing … […]

Eek, I’ve got a lot to learn when I can’t understand some of the pros and cons. I’ve heard good things about them, sounds like a great option.

I initially struggled at level I and level II jargon, now I can take classes 🙂

[…] @ Finance Product Reviews writes Zecco Trading Review – This is an honest review of Zecco Online brokers. Zecco is not free anymore but they have a […]

[…] @ Finance Product Reviews writes Zecco Trading Review – This is an honest review of Zecco Online brokers. Zecco is not free anymore but they have a […]

I wonder if I am missing a trading definition – you use “treading” frequently. Does it have a specific definition related to investing?

We use Vanguard and have enough that our commissions are very low.

Ok, good catch it was my auto spell checker I guess. As far I can remember, ‘Trading’ is what I intended to use. I should spend more time proof reading now going forward.

$4.95 is a great transaction price compared to competitors. If you are going to be doing your own buying, you might as well go with a lower price broker and boost what every earnings you can get.

[…] with Finance Product Reviews writes Zecco Trading Review – This is an honest review of Zecco Online brokers. Zecco is not free anymore but they have a […]

[…] Zecco Trading Review – Online Stock Brokers that are not Zero Cost Any More […]

[…] Zecco Trading Review – Online Stock Brokers that are not Zero Cost Any More […]

[…] Product Reviews writes Zecco Trading Review – This is an honest review of Zecco Online brokers. Zecco is not free anymore but they have a very […]

[…] Stock Investing Advice and ResearchZecco Trading Review – Online Stock Brokers that are not Zero Cost Any More […]